Posted:11-August-2011

British businesses could lose on £2.9billion in growth by failing to prepare for London 2012

- Latest Lloyds TSB Commercial Business in Britain report shows businesses are still reluctant to invest for future growth

- Firms’ confidence has risen but remains below its long term survey average, indicating continued sluggish recovery in the near-term, consistent with Lloyds Banking Group’s projection of 1.3 per cent GDP growth in 2011

- Lack of domestic demand is still the biggest threat to UK firms, while export market growth continues to accelerate

- Outlook for profits remains weak, as price rises are offset by rising costs

British businesses still lack the confidence to invest for growth, as weak domestic demand and cost pressures continue to dent profits, meaning that economic prospects remain fragile, according to the latest Business in Britain report from Lloyds TSB Commercial.

John Maltby, managing director, Lloyds TSB Commercial said:“With domestic demand in the doldrums, and confidence still muted, it is understandable that firms are worried about investing for the future. But the fact is that if businesses do not invest it could damage an already fragile recovery, and result in even slower growth.”

Lack of investment

The six monthly report, now in its twentieth year, canvasses the views of more than 1,800 businesses across the UK and shows that less than one fifth (19 per cent) of business expect to increase their level of investment over the coming six months, while just over a fifth (21 per cent) plan cuts. This means that the overall balance of firms planning investment remains in negative territory at minus 2 per cent, and has actually fallen since the last survey in January, when the balance was minus 1 per cent.

John Maltby added: “Getting access to finance is critical if businesses are to invest effectively and we want to send out a clear signal that Lloyds TSB is lending to good businesses and that we are doing so fairly and competitively.”

Confidence a little higher but still low

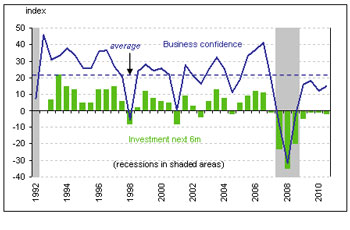

The survey’s key Business Confidence Index, which is based on businesses’ expectations for sales orders and profits over the next six months, has risen slightly, to 15 per cent, from 12 per cent in the previous survey.

Confidence has been helped by a rise in the number of companies expecting stronger sales, and a stable outlook for order books, but profitability is still a real concern and has had an impact on firms’ overall sentiment for the rest of the year. The Business Confidence Index, although up slightly on the past six months, remains below its level just a year ago (18 per cent). It is also below the survey average of 21 per cent and the peak of 41 per cent reached in 2007.

Business in Britain Confidence Index:

Sales and exports

A continuing trend is that firms with exposure to overseas markets are faring better than those reliant on home markets, where conditions are weak. The survey shows that businesses expectations for export sales are at their highest level since 2004. Almost half of UK firms (46 per cent) say they expect to boost exports over the coming six months, and with just eight percent expecting a decline the overall balance of businesses expecting to increase exports has now reached 38 per cent, compared to 34 per cent in the last survey.

Strong export trade has underpinned the general strengthening of sales expectations that has helped to support overall confidence. However, buoyant international demand belies a much more subdued outlook at home. Domestic demand is, for more than half of respondents (56 per cent), still by far the biggest threat to their business.

Prices and profits

Businesses have followed through on plans to increase prices since the last survey in January. More than a third of businesses (36 per cent) have pushed up prices over the past six months, while 18 per cent cut prices. This represents an overall balance of 18 per cent, which is the highest in three years and is exactly in line with the balance of firms that said they would increase prices, when surveyed in January. This trend is expected to continue, with a balance of 20 per cent of firms planning price increases over the coming six months.

Despite these plans to raise prices, businesses are not expecting an increase in profits after recent falls. Only a quarter (27 per cent) of firms expect higher profits over the next six months, while 28 per cent expect to see a fall – resulting in a negative net balance of minus 1 per cent, which is below the long term average of 11 per cent. This pressure on profits is coming mainly from material and energy costs, which are squeezing margins.

The sectors and regions

Despite concerns over domestic demand, the reports shows that hospitality and leisure is the sector in which confidence is strongest (a net balance of 33 per cent), while business services (31 per cent) and manufacturing (26 per cent) are also positive in their outlook. Healthcare is the weakest sector, and the only sector in which confidence is negative, at minus 2 per cent - almost level with the balance of minus 3 recorded in the survey six months ago. This continuing negativity is likely to be the result of concerns about spending cuts in the sector. Investment trends in healthcare, however, remain strong, suggesting good medium-term prospects. Retail & wholesale (9 per cent) and construction (4 per cent) were the other weakest sectors.

London has kept its place at the top of the confidence table for the regions, with a net balance of 24 per cent while Wales has witnessed a dramatic turnaround, with confidence rising to a balance of 20 per cent from just minus 8 per cent in the last survey. At the other end of the spectrum, the North East and North West are the least confident regions with respective confidence balances of just 3 per cent and 6 per cent, suggesting that the impact of the Government’s fiscal plans may be having a more significant impact in these regions.

The economic perspective

Trevor Williams, Chief Economist, Lloyds Bank Corporate Markets, said: “Businesses are on a better footing than they were at this point last year but they need to steer the right course between domestic and international markets in order to ensure their prospects for the coming year are positive. Investment at home is vital if businesses are to stay competitive, but with domestic trade prospects still weak businesses need do more to tap into export markets to ensure they grow in the longer term.

“As inflation is expected to peak later this year or early in 2012 and the underlying economic recovery remains intact, the hope is that businesses that are currently putting plans on hold will have the confidence to ramp up their investment spending. Investment is the springboard for innovation and productivity, which in turn supports competitiveness – and ultimately economic growth.

“Our latest report underlines the view that the pace of economic recovery is still sluggish but, risks notwithstanding, we believe the recovery will continue in the second half.”